Riding the AI revolution

How Fidelity managers are seeking the winners of tomorrow.

- A massive boom in spending on artificial intelligence (AI) infrastructure has been impacting nearly every US sector, and has become a major driver of US economic growth.

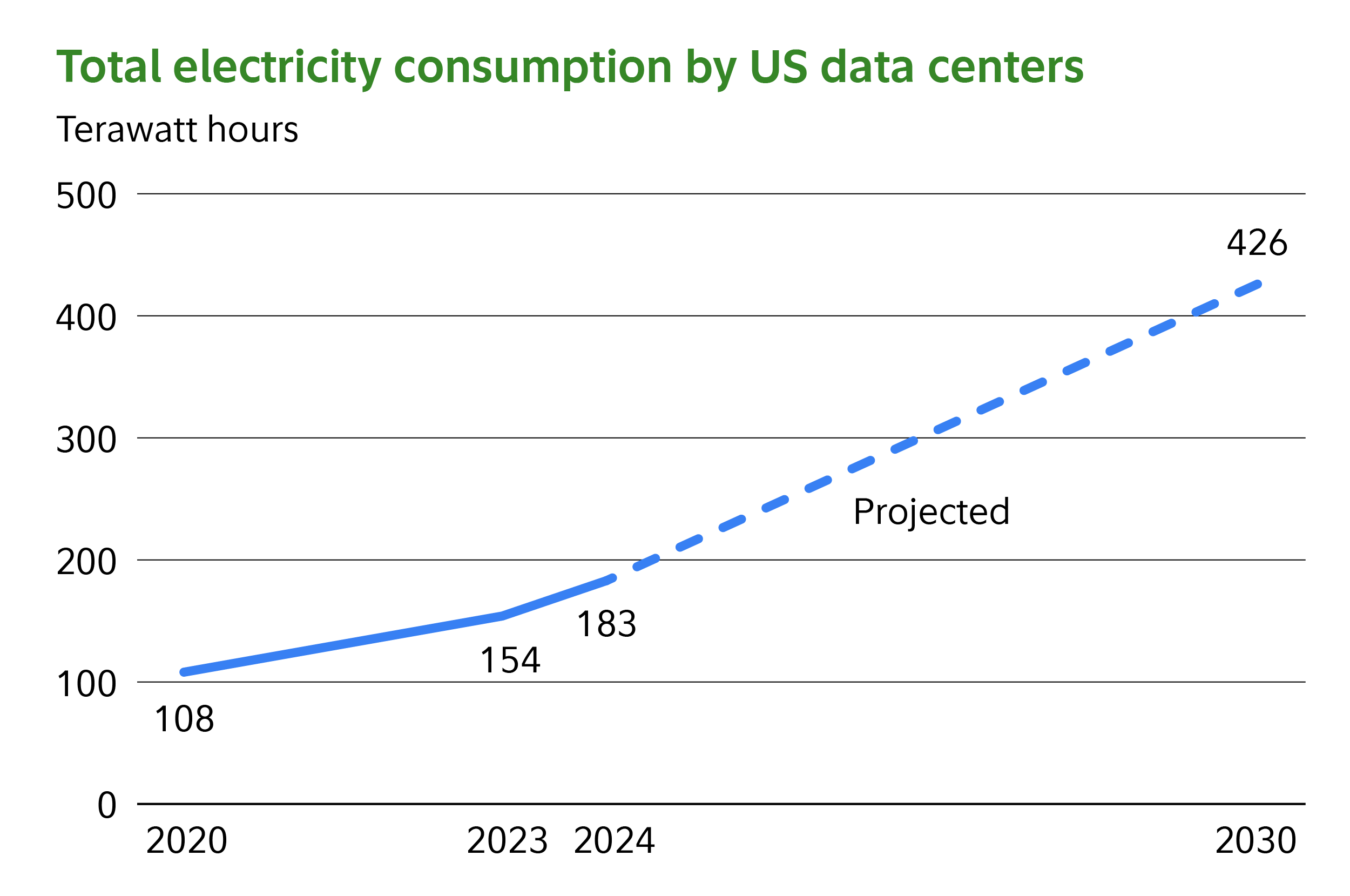

- AI requires vast quantities of computational power and electricity.

- Fidelity managers have found potential opportunity among the chipmakers, utilities, energy providers, and others helping to build out this capacity.

- It's not yet clear exactly how AI may be used in the future. As with other major technological revolutions, the rise of AI may be a long-term story.

The AI boom has come a long way from its unassuming origins as a novel variety of chatbot.

Far from just a story about new ways to generate images or get answers online, AI has evolved into the story of a profound long-term infrastructure buildout—drawing parallels to the construction of the transcontinental railways in the 1800s, the interstate highway system in the 1950s, and the backbone of the internet in the 1990s.

This tech and infrastructure arms race accelerated in 2025 as tech giants, chipmakers, and cloud providers struck multibillion-dollar deals to lay the foundation for AI’s next era. From rare earth minerals to energy infrastructure to data-center real estate deals, the AI boom is now touching nearly every US market sector, and has accounted for roughly 60% of recent economic growth, according to estimates by Fidelity’s Asset Allocation Research Team.1

“AI is the most powerful and far-reaching of all the cycles of innovation and disruption I’ve seen in my 25 years following tech,” says Adam Benjamin, portfolio manager at Fidelity. “It’s overshadowing everything else.”

Yet for investors, the question for 2026 isn’t just whether AI will be disruptive. It’s whether the eventual profits will justify the cost of the current buildout. It’s whether the winners of today will still be the winners of tomorrow. And perhaps most of all, it’s whether today’s prices for AI stocks will one day look like a bargain or a bubble.

Big tech still dazzles

These questions are playing out amid the massive capital spending cycle now unfolding across the largest tech companies. Collectively, Amazon ( AMZN),2 Microsoft (MSFT),3 Alphabet (GOOGL),4 and Meta Platforms (META)5 have lifted their annual investment spending (i.e., capital expenditures, or CapEx) from roughly $100 billion in 2023 to more than $300 billion in 2025—a figure that could exceed half a trillion dollars within the next few years, according to Priyanshu Bakshi, portfolio manager at Fidelity.

The Magnificent 7 have defined the AI trade ever since OpenAI first launched ChatGPT in late 2022. The group—typically considered to include NVIDIA (NVDA),6 Microsoft, Apple (AAPL),7 Alphabet, Amazon, Meta, and Tesla (TSLA)8—has also dominated market returns in that period, rising to comprise around a third of the value of the S&P 500® Index.

Bakshi says this group still appears to offer sound long-term prospects. Earnings for this cohort have generally been clocking in the mid-20% range, compared with flat or mid-single-digit growth for the rest of the S&P 500, he notes. Given that growth differential and their strong competitive moats, he views their recent mid-20s price-to-earnings (PE) valuations as fair.

Among Bakshi’s largest holdings are Meta and Alphabet, both of which are not only investing heavily in AI, but already seeing early benefits of AI in improving ad sales. Together the companies have been generating close to $500 billion annually in digital ad revenue. AI has been helping to boost efficiency of ads and could continue to do so, through a deeper understanding of each user’s real-time behavior, leading to better personalized ad targeting. “I believe there’s still a lot of runway for improvement,” he says.

Captains of compute

Despite AI’s early successes, Chris Lin, portfolio manager at Fidelity, says it’s hard to predict how AI will evolve or how long it will take to become widely adopted. “Nobody knows how long it will take to play out, but I believe most investors are underestimating how impactful AI will ultimately be,” he says.

At this stage, Lin points to the semiconductor companies creating the computing power behind AI as some of the clearest potential beneficiaries. He believes NVIDIA and Taiwan Semiconductor Manufacturing Co. (TSM),9 2 of his fund’s largest holdings, may be among the best-positioned players in the AI value chain. “AI requires computation, and these 2 companies are the main providers of it,” he says.

Lin says AI is still in the investment phase, and monetization of AI—i.e., making money from AI itself rather than from its buildout—is still nascent. “Companies are monetizing it today, but still at a relatively small scale.” He views today’s heavy spending as a necessary step, laying the groundwork for future revenue and earnings growth as AI applications expand.

To train, run, and scale the next generation of AI models, developers need vast amounts of computational power. Unlike earlier phases focused mainly on pattern recognition, the latest AI models are designed to reason before responding—the same way a person might think before answering a question. “We’re really trying to recreate human intelligence,” says Benjamin. “And that requires multiples of higher compute intensity.”

Crucial in the race to make this possible, says Benjamin, is the expanding group of companies supplying the hardware capable of conjuring up this large-scale computing—chips, but also memory, interconnects, networking, and advanced packaging.

“NVIDIA isn’t just a chip company anymore,” he says. “They’re selling full rack-scale systems—essentially complete supercomputers designed to train and run AI models.” Achieving further gains in computing power relies less on producing ever-more-powerful chips, and more on improvements in that full system. “The next wave of gains is happening at the system level, not the chip level. This is a rack-scale problem now,” he says.

That evolution is broadening opportunities across semiconductors, from high-bandwidth memory suppliers like Micron Technology (MU),10 which makes high-speed memory chips that feed data to AI processors quickly, to Broadcom (AVGO)11 and Marvell Technology (MRVL),12 which partner with big cloud providers to design custom chips (i.e., application-specific integrated circuits, or ASICs), to speed up AI workloads. Taiwan Semiconductor, meanwhile, provides the leading-edge manufacturing and advanced packaging technologies that allow chips to be stacked, linked, and cooled in ways that support large-scale AI compute. “All of these things are coming together,” Benjamin says. “There isn’t one that’s most important—they’re all critical facets that have to work together.”

Benjamin takes what he calls an “AI-basket” approach in his funds, evaluating risk-adjusted exposures across semiconductors, hardware, software, and services in seeking to capture both the beneficiaries and the potential disruptors as the AI ecosystem evolves.

A power renaissance

The growth in AI-driven CapEx is rippling across sectors as companies race to build and connect mega-scale data centers needed to train and run AI systems.

Surging energy demand is fueling a “power renaissance,” says Clayton Pfannenstiel, portfolio manager at Fidelity. While these data centers are expected to take years to complete, he notes, they target gigawatt-level power loads—comparable to the electricity needs of a small city—and carry price tags well into the tens of billions of dollars.

Data as of April 2025. Source: International Energy Agency, "Energy and AI."

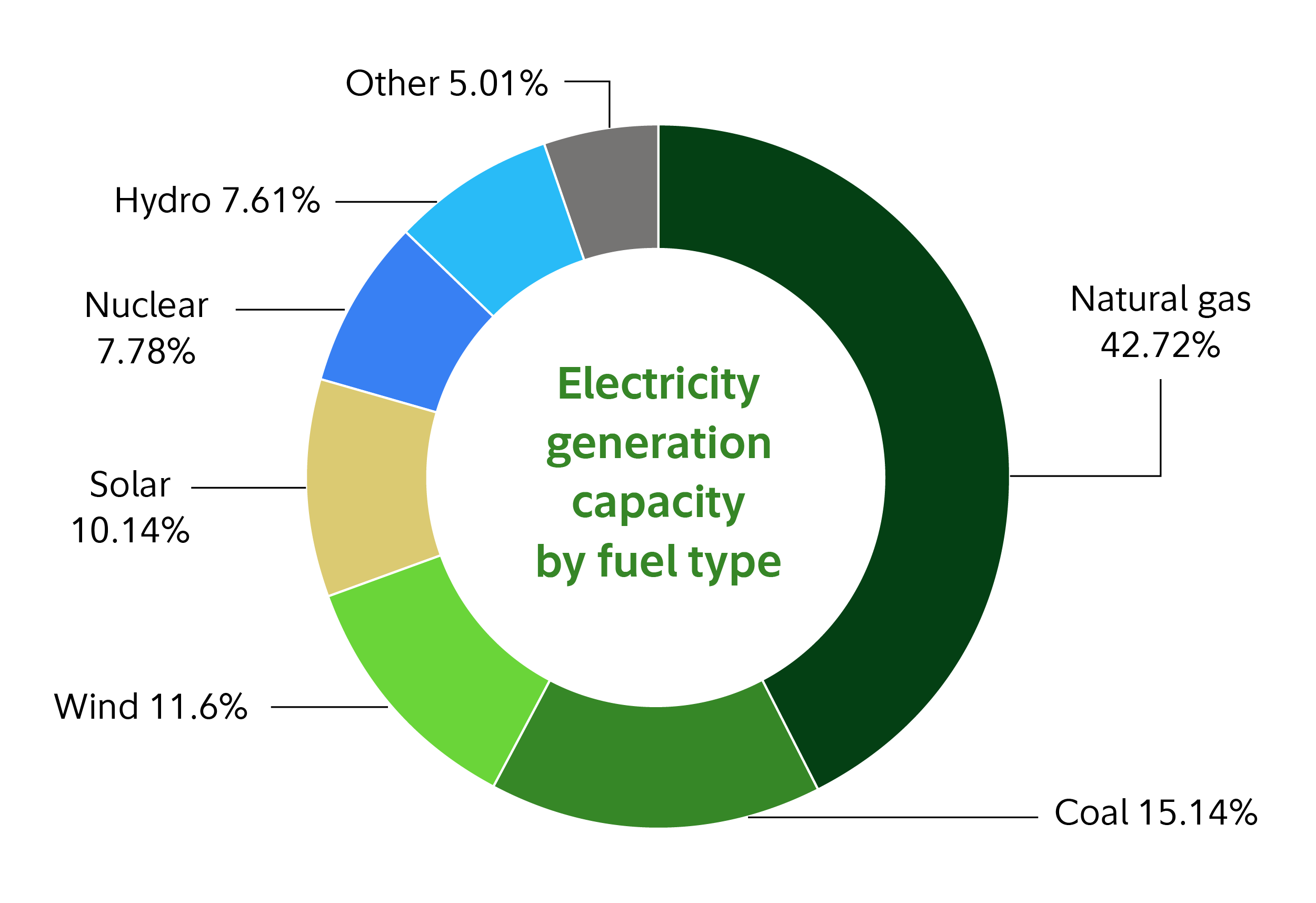

While data centers are expected to rely on a mix of energy sources, natural-gas turbines have emerged as the most practical option to meet near-term additional demand, Pfannenstiel says. Renewables continue to expand, but their output is still too variable to meet the uninterrupted power demands of these facilities, he says. Nuclear power could eventually help meet that need, Pfannenstiel notes, but US deployment remains a long-term prospect. Pfannenstiel sees promise in small modular reactor designs such as those from Rolls-Royce (RYCEY),13 though they’re unlikely to come online before the 2030s.

“If we need power now, the main source is gas turbines,” Pfannenstiel says. Among industrial manufacturers, he highlights GE Vernova (GEV),14 the energy company spun off from GE in 2024, as part of the former conglomerate’s split into 3 distinct businesses. GE Vernova has seen an increase in turbine orders, leading to upward revisions to its earnings and cash-flow forecasts.

Pfannenstiel has found other potential AI beneficiaries across the power and infrastructure chain, including Eaton Corp. (ETN),15 which supplies the electrical systems that deliver and manage the intensive power needs of data centers, and Trane Technologies (TT),16 which provides the specialized cooling and HVAC systems these facilities require. He adds that the buildout faces bottlenecks, particularly in grid connectivity and skilled labor—a trend his fund has played through holdings such as Quanta Services (PWR),17 a contractor for utilities. But overall, Pfannenstiel sees a multi-year industrial cycle taking shape. “AI is still in the build phase,” he says. “There are a lot of ‘picks and shovels’ companies that could potentially benefit.”

Data for 2024 as reported in April 2025. Source: International Energy Agency, "Energy and AI."

Kristen Dougherty, portfolio manager at Fidelity, notes that the acceleration of AI-related power demand is impacting both the industrial companies building the infrastructure and the energy systems that supply it.

“AI is the single biggest contributor to rising power demand in the US, reversing years of gradual decline,” she says.

Like Pfannenstiel, she expects natural gas—not renewables or nuclear—to be the main near-term power source for AI data centers, given their need for constant, reliable electricity. Still, Dougherty says she’s cautious about chasing the AI theme broadly. She notes that US natural gas supply is abundant and can grow quickly to meet demand, making it harder for prices to rise as power demand grows. Much of the enthusiasm around AI-driven energy demand, she adds, might already be reflected in stock prices. “It will be a growth driver,” she says, “but the key is being selective and sticking to fundamentals.”

One potential beneficiary that has met that selective process is Vistra (VST),18 an independent power producer. Unlike regulated utilities, independent power producers like Vistra have greater flexibility to charge higher prices when demand rises—allowing for greater upside potential. Another has been Energy Transfer (ET),19 an energy infrastructure company that builds and operates the pipelines and processing facilities needed to move natural gas from production sites to power-hungry customers like AI data centers.

Utilities step into the limelight

As data centers come online, utilities face the challenge of adding new power generation and interconnecting large loads to the grid.

“Power is the feedstock for AI,” says Pranay Kirpalani, portfolio manager at Fidelity. He notes that AI racks and semiconductors are extremely power-hungry, with a single ChatGPT query consuming roughly 10 times more power than a Google search. The limiting factor, he says, might not be computing power but rather the availability of electricity itself. After roughly 2 decades of flat demand, utilities are now in “a massive CapEx cycle” to both build new generation and expand transmission and distribution lines.

Most US utilities are regulated, earning a set return on the capital they invest. “For that portion of the industry, this represents a capital-deployment opportunity, meaning the ability to deploy more capital at regulated rates of return,” he says. By contrast, independent power producers can sell power at market prices—providing the opportunity to benefit from rising prices when power demand rises.

Kirpalani has been finding potential opportunity in both groups—focusing on fundamentals and 3- to 5-year earnings potential. Potential beneficiaries he’s found have included Entergy (ETR),20 a regulated utility building new generation and transmission to supply data centers for some of the largest tech companies, as well as independent power producers Vistra and NRG Energy (NRG).21

He's also bullish on nuclear energy as a longer-term story, given its ability to provide reliable, consistent power. One company that’s exemplified this theme is Constellation Energy (CEG),22 the nation’s largest nuclear-power operator. Another recent position has been NextEra Energy (NEE),23 a company that combines a Florida utility with the country’s largest renewable-energy developer. “The need for power is not slowing down,” says Kirpalani. “We need all forms of energy we can get.”

Selling “picks and shovels” in a gold rush

The “picks-and-shovels” aspect of the AI infrastructure buildout also includes companies involved in wiring, building roads, transportation, and data-center site preparation, says Shilpa Mehra, manager of the Fidelity® Growth Strategies Fund (FDEGX) and Fidelity® Trend Fund (FTRNX).

She cites companies such as Comfort Systems USA (FIX)24 and EMCOR Group (EME),25 which specialize in mechanical and electrical systems and have significant exposure to data centers and related infrastructure. Other companies that she believes have exemplified this thesis include Sterling Infrastructure (STRL),26 which prepares sites for the construction of facilities like data centers and semiconductor plants, and Construction Partners (ROAD),27 which builds roads and other access routes for industrial sites, including data centers. Revenues at these companies are less dependent on which AI platform leads, and more on the scale and timing of construction, says Mehra.

“These companies are in a powerful cycle,” says Mehra. “Demand is significant and appears likely to continue for years.” Tight skilled-labor markets are also having an impact. With electricians and technicians in short supply, she notes, these companies have improved pricing power and the ability to be selective on bids.

But is it a bubble?

As mega-cap tech firms ramp up spending on data-center infrastructure, and AI startups strike multibillion-dollar partnerships to secure computing power, many investors are asking a broader question: How much of this growth is sustainable—and are markets in a speculative bubble?

“The market can get ahead of itself,” says Benjamin. “At times it can oversimplify, get overly excited, and assume things will happen faster than they actually will.”

It's no secret that AI hype has been propelling markets, and that companies perceived as “AI stocks” have generally been enjoying higher valuations. Some signs of froth have emerged, says Mehra, such as startups receiving high valuations based on the speculative potential for AI benefits down the road. Companies are investing today in the faith that highly profitable business applications of AI will eventually emerge, but if the timing or magnitude of those profits disappoint, the AI trade could be susceptible to pullbacks.

While the excesses of the late 1990s internet boom have been top of mind for many wary investors, there are also key differences between the current buildout and the overbuilding of that period. Chief among them: Today’s AI spending is overwhelmingly being funded with cash, not debt, by companies that regularly generate high volumes of free cash flow. And from a historical perspective, “valuations today are not even close to what’s been experienced during bubble extremes of the past,” says Jurrien Timmer, Fidelity’s director of global macro.

Investing in AI today might be a leap of faith. And yet—betting on the ingenuity and dynamism of technological innovators has, at times, worked out well for investors who took the leap. Just look at where companies like Alphabet, Amazon, and Meta were 2 decades ago.

“In the grand arc of time, I believe AI has the potential to be one of the most profound technologies that mankind has ever created,” says Lin. “Everything starts with intelligence.”

Next steps to consider

Sector/Industry

Target specific segments of the economy with our full spectrum of sector funds, ETFs, and other solutions.

Learn more

Asset Allocation Research Team (AART)

Access economic, fundamental, and quantitative analysis from our Asset Allocation Research Team.

Learn more

Domestic Equity

Target your clients’ investment needs with our broad lineup of domestic equity solutions.

Learn more

Related insights

View all

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully

1. Investment is private-sector investment. Source: "Quarterly Market Update, Fourth Quarter 2025," Fidelity Asset Allocation Research Team, as of September 30, 2025.

2. Fidelity OTC Portfolio held a 5.995% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 4.704% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 4.90% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 4.61% position in this stock as of December 5, 2025. Fidelity Select Technology Portfolio held a 1.385% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 4.956% position in this stock as of October 31, 2025.

3. Fidelity OTC Portfolio held a 9.720% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 0.625% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 1.25% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 5.52% position in this stock as of December 5, 2025. Fidelity Select Technology Portfolio held a 9.872% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 6.473% position in this stock as of October 31, 2025.

4. Fidelity OTC Portfolio held a 8.952% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 28.431% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 7.97% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 4.25% position in this stock as of December 5, 2025. Fidelity Trend Fund held a 3.958% position in this stock as of October 31, 2025.

5. Fidelity OTC Portfolio held a 3.731% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 20.576% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 6.57% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 4.18% position in this stock as of December 5, 2025. Fidelity Trend Fund held a 3.646% position in this stock as of October 31, 2025.

6. Fidelity Disruptive Communications ETF held a 5.75% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 6.06% position in this stock as of December 5, 2025. Fidelity Infrastructure Fund held a 8.179% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 15.737% position in this stock as of October 31, 2025. Fidelity Select Semiconductors Portfolio held a 25.729% position in this stock as of October 31, 2025. Fidelity Select Technology Portfolio held a 25.970% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 14.408% position in this stock as of October 31, 2025.

7. Fidelity OTC Portfolio held a 10.542% position in this stock as of October 31, 2025. Fidelity Select Technology Portfolio held a 11.702% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 2.47% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 1.69% position in this stock as of December 5, 2025. Fidelity Trend Fund held a 6.120% position in this stock as of October 31, 2025.

8. Fidelity OTC Portfolio held a 1.764% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 3.433% position in this stock as of October 31, 2025.

9. Fidelity Infrastructure Fund held a 2.448% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 2.797% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 1.241% position in this stock as of October 31, 2025. Fidelity Select Semiconductors Portfolio held a 3.699% position in this stock as of October 31, 2025. Fidelity Select Technology Portfolio held a 2.573% position in this stock as of October 31, 2025. Fidelity Disruptive Communications ETF held a 7.77% position in this stock as of December 5, 2025. Fidelity Disruptive Technology ETF held a 6.45% position in this stock as of December 5, 2025. Fidelity Trend Fund held a 0.560% position in this stock as of October 31, 2025.

10. Fidelity OTC Portfolio held a 1.219% position in this stock as of October 31, 2025. Fidelity Select Semiconductors Portfolio held a 7.092% position in this stock as of October 31, 2025. Fidelity Select Technology Portfolio held a 2.576% position in this stock as of October 31, 2025. Fidelity Disruptive Technology ETF held a 3.42% position in this stock as of December 5, 2025. Fidelity Select Communication Services Portfolio held a 0.722% position in this stock as of October 31, 2025.

11. Fidelity Infrastructure Fund held a 3.044% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 3.391% position in this stock as of October 31, 2025. Fidelity Select Semiconductors Portfolio held a 12.440% position in this stock as of October 31, 2025. Fidelity Disruptive Technology ETF held a 0.93% position in this stock as of December 5, 2025. Fidelity Trend Fund held a 5.138% position in this stock as of October 31, 2025.

12. Fidelity OTC Portfolio held a 1.324% position in this stock as of October 31, 2025. Fidelity Select Communication Services Portfolio held a 0.893% position in this stock as of October 31, 2025. Fidelity Select Technology Portfolio held a 5.042% position in this stock as of October 31, 2025. Fidelity Disruptive Technology ETF held a 5.17% position in this stock as of December 5, 2025. Fidelity Select Semiconductors Portfolio held a 9.430% position in this stock as of October 31, 2025.

13. Fidelity Select Industrials Portfolio held no position in this stock as of October 31, 2025.

14. Fidelity Growth Strategies Fund held a 0.137% position in this stock as of October 31, 2025. Fidelity Infrastructure Fund held a 1.333% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 0.660% position in this stock as of October 31, 2025. Fidelity Select Industrials Portfolio held a 5.348% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 1.256% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 0.482% position in this stock as of October 31, 2025.

15. Fidelity Select Industrials Portfolio held a 3.956% position in this stock as of October 31, 2025.

16. Fidelity Growth Strategies Fund held a 0.549% position in this stock as of October 31, 2025. Fidelity Select Industrials Portfolio held a 5.641% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 0.476% position in this stock as of October 31, 2025.

17. Fidelity Growth Strategies Fund held a 0.873% position in this stock as of October 31, 2025. Fidelity Infrastructure Fund held a 0.630% position in this stock as of October 31, 2025. Fidelity Select Industrials Portfolio held a 2.405% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 1.288% position in this stock as of October 31, 2025.

18. Fidelity Growth Strategies Fund held a 1.613% position in this stock as of October 31, 2025. Fidelity Infrastructure Fund held a 3.386% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 0.465% position in this stock as of October 31, 2025. Fidelity Select Energy Portfolio held a 2.984% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 5.612% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 0.141% position in this stock as of October 31, 2025.

19. Fidelity Select Energy Portfolio held a 4.432% position in this stock as of October 31, 2025.

20. Fidelity Infrastructure Fund held a 2.214% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 4.722% position in this stock as of October 31, 2025.

21. Fidelity Growth Strategies Fund held a 1.231% position in this stock as of October 31, 2025. Fidelity Infrastructure Fund held a 2.680% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 0.487% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 4.629% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 0.158% position in this stock as of October 31, 2025.

22. Fidelity Infrastructure Fund held a 5.252% position in this stock as of October 31, 2025. Fidelity OTC Portfolio held a 0.340% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 9.549% position in this stock as of October 31, 2025.

23. Fidelity Infrastructure Fund held a 5.553% position in this stock as of October 31, 2025. Fidelity Select Utilities Portfolio held a 12.367% position in this stock as of October 31, 2025.

24. Fidelity Growth Strategies Fund held a 1.929% position in this stock as of October 31, 2025. Fidelity Select Industrials Portfolio held a 1.451% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 1.322% position in this stock as of October 31, 2025.

25. Fidelity Growth Strategies Fund held a 1.253% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 1.153% position in this stock as of October 31, 2025.

26. Fidelity Growth Strategies Fund held a 2.225% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 2.392% position in this stock as of October 31, 2025. Fidelity Infrastructure Fund held a 0.497% position in this stock as of October 31, 2025.

27. Fidelity Growth Strategies Fund held a 1.171% position in this stock as of October 31, 2025. Fidelity Trend Fund held a 1.112% position in this stock as of October 31, 2025.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. Fidelity is not recommending or endorsing this investment by making it available to its customers.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

The technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic condition.

The communication services industries can be significantly affected by government regulation, intense competition, technology changes and general economic conditions, consumer and business confidence and spending, and changes in consumer and business preferences. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. The fund may have additional volatility because of its narrow concentration in a specific industry. Non-diversified funds that focus on a relatively small number of stocks tend to be more volatile than diversified funds.

Industrials industries can be significantly affected by general economic trends, changes in consumer sentiment and spending, commodity prices, legislation, government regulation and spending, import controls, and worldwide competition, and can be subject to liability for environmental damage, depletion of resources, and mandated expenditures for safety and pollution control.

The utilities industries can be significantly affected by government regulation, financing difficulties, supply and demand of services or fuel, and natural resource conservation.

The energy industries can be significantly affected by fluctuations in energy prices and supply and demand of energy fuels, energy conservation, the success of exploration projects, and tax and other government regulations.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

ETFs are subject to market fluctuation and the risks of their underlying investments.

ETFs are subject to management fees and other expenses.

The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC