Why active management may be better for bond funds

Active bond funds have historically outperformed passive ones.

- Actively managed bond mutual funds and ETFs may deliver higher returns than passive bond funds that are designed to track the performance of an index.

- Active bond managers may be able to balance risk and return seeking more effectively than passive funds.

- Actively managed bond funds can take advantage of opportunities created by the size, complexity, and inefficiency of bond markets in ways that passive strategies cannot.

- Managers of active bond funds may also be able to take advantage of opportunities created by changing interest-rate and credit conditions while passive funds can only seek to track an index.

Bond mutual funds and exchange-traded funds (ETFs) are a convenient way to add fixed income exposure to an investor's portfolio. They can offer income, diversification, and easy access to an investor's money to help achieve investment objectives.

Investors who want to add a bond fund to their portfolio have plenty of options to choose from—and plenty of things to consider when making that choice. One of those considerations is whether to choose an actively managed fund whose professional manager seeks to deliver a higher return than that of an index, or a passive fund that seeks only to duplicate an index’s performance.

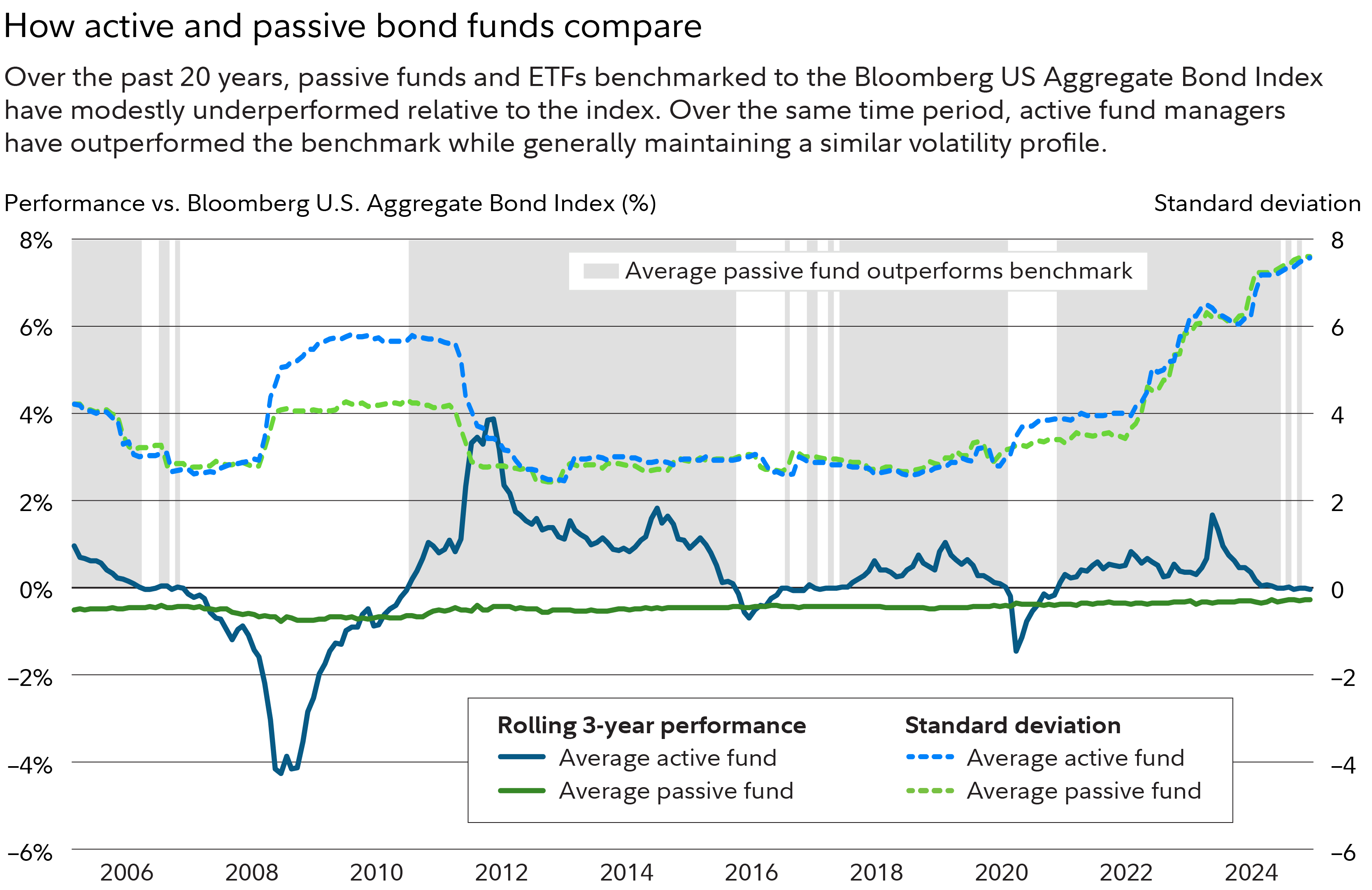

While passive funds tend to come with lower expenses than actively managed ones, the latter can offer higher returns after expenses. This is particularly true of bond funds, since the universe of bonds is so much bigger and trading is more complex than with stocks. Indeed, actively managed bond funds have outperformed their benchmarks much more frequently than actively managed stock funds.

What works for stocks may not work for bonds

Many investors find passively managed index mutual funds or ETFs to be good options for stock investing. However, they may also find that actively managed funds can offer significant advantages over passive funds for bond investing.

Stock markets offer investors opportunities to buy or sell shares of a relatively small number of companies and the process of valuing, buying, and selling stocks is efficient. Bond markets, however, are much larger, more complex, and far less efficient. That’s not necessarily a bad thing, but it does suggest that differing investment strategies may be needed in differing markets.

Unlike stock markets where even the most skilled and experienced managers may struggle to outperform popular market indexes such as the S&P 500 over time, the very size, complexity, and inefficiency of the bond markets has historically created opportunities for skilled active managers to outperform popular indexes.

In fact, the majority of active bond managers have outperformed their benchmark indexes over time, sometimes significantly. Meanwhile, passive bond investing strategies have sometimes struggled to deliver performance that matches their benchmark indexes because broad-based fixed income indexes are more difficult to replicate than stock indexes are. Remember, though, that past performance is no guarantee of future results.

Data as of Sept. 30, 2024. Includes all passive funds in the Morningstar Intermediate Core Bond and all active funds in the Intermediate Core-Plus categories with the Bloomberg US Aggregate Bond Index listed as primary prospectus benchmark. Percentage of average active and average passive peers based on the 228 months from October 2005 through September 2024. Standard deviation measures the dispersion of performance from the average. Past performance is no guarantee of future results. It is not possible to invest directly in an index. Source: Morningstar, Fidelity Investments.

Active bond managers have more opportunities

It's important to understand how big the bond market really is to understand the importance of active management. A stock market index such as the S&P 500 can provide easy exposure to the biggest—and often most attractive—stocks in the market and a passive strategy that tracks it can give an investor exposure to a meaningfully large group of stocks.

By comparison, the investible universe of bonds is so large and diverse that even a broad-based index such as the Bloomberg US Aggregate Bond Index (often referred to as the Agg) can only reflect a relatively small portion of the market.

The Agg contains more than 25 times the number of securities as the S&P, but that still represents just a sliver of the $58 trillion bond market according to the Securities Industry and Financial Markets Association (SIFMA) that an active manager can invest in. That means if an investor chooses an index fund that seeks only to track the Agg, they've effectively put most of the potential opportunities in the bond market off limits.

What’s in an index?

While the securities in an actively managed bond portfolio are all there because an experienced manager believes they offer opportunities, the securities in a passive index-tracking bond strategy simply reflect what is in a portion of the market, which may not always be what an investor wants.

Unlike a stock index which will always contain stocks issued by companies, the composition of an index like the agg that includes a much more diverse variety of assets may change significantly over time. Those changes can have a meaningful impact on the performance and characteristics of the index. For example, US Treasury bonds made up 35% of the Agg in 2014. By 2024 however, they accounted for 44% of its value. The change resulted not from a manager seeing an opportunity in Treasurys but from the government issuing more bonds as deficit spending increased. Over that time period, a passive index-tracking fund would have increased its exposure to Treasurys to match the changing composition of the Agg, likely changing the return and risk characteristics of the portfolio over that time.

How active bond managers manage

The size, complexity, and inefficiency of bond markets mean they often don’t value bonds in ways that everybody agrees on. As a result, sometimes some bonds may be priced higher—or lower—than their fundamental characteristics suggest they should be. Active managers can create value for the investors in the funds they manage by looking for mispriced bonds, buying the underpriced bonds and selling the overpriced bonds. In contrast, passive funds can’t consider valuations and fundamentals, they can only seek to replicate the composition of an index.

Active managers can do this because unlike passively managed funds, they can analyze a wide variety of factors and choose which bonds to buy and which to sell in an effort to outperform the index. They can draw on expert researchers and traders to sort through the unique characteristics of bond markets and discover attractive investment opportunities that passive strategies miss.

Besides being able to research, buy, and sell a wider range of bonds than a passive strategy can, active bond fund managers also have the flexibility to change some important characteristics of the portfolios they manage to potentially enhance total return (the return generated from both interest income and capital appreciation from rising bond prices).

For example, because bond prices fluctuate as interest rates change, a changing rate environment can have a significant impact on a fund’s total return. While a passive fund must reflect the composition of its benchmark index, regardless of how rates move, an active manager can use research and trading resources to help reposition a portfolio to seek to take advantage of changing rates and manage the volatility which can accompany rate moves.

For example, if a rate hike by the Federal Reserve were to push bond prices—and the Agg—down, a passive fund would simply track the index and move lower, hurting the value of an investor's portfolio. However, an active manager may be able to cushion the impact of the rate hike by buying bonds with shorter maturities that tend to be less sensitive to changing rates and avoiding others that are more likely to fall in price when rates rise.

Finding ideas

If an investor is interested in adding an actively managed bond fund to their portfolio, Fidelity’s research tools can help choose a fund that aligns with their goals. Here are some questions to consider while researching funds:

- Do they want a mutual fund or an ETF? Each has its own advantages and one may be more suitable for them than the other.

- Does a manager have the resources to find market inefficiencies, analyze the risks, and buy and sell bonds efficiently?

- Do the potential returns and risks of the fund align with the investors' objectives? For example, if an investor's goal is to diversify a portfolio of stocks, they might prefer a strategy with lower historical correlations to stocks.

- How much risk is a manager taking? If a manager is earning higher returns by investing in riskier bonds, an investor might consider whether the returns are worth the extra risk.

- Where is risk coming from? Two risks in a bond fund are the possibility that bonds will default (credit risk) and sensitivity to interest-rate changes (duration). An active bond fund’s level of credit risk and a duration target can be set by the manager so an investor may want to understand how and why the risks differ from those of the benchmark index.

- How much flexibility does the manager have in choosing the sector, credit quality, and interest-rate sensitivity of the holdings? An investor seeking diversification may prefer different guidelines than an investor seeking income.

- How are investment decisions made and monitored at the firm managing the fund? What incentives are put in place to maintain appropriate risk levels?

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. Read it carefully.

The views expressed are as of the date indicated and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author, as applicable, and not necessarily those of Fidelity Investments. The third-party contributors are not employed by Fidelity but are compensated for their services.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. Fidelity is not recommending or endorsing this investment by making it available to its customers.

Past performance is no guarantee of future results.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-back securities (agency fixed-rate pass-throughs), asset-backed securities and collateralised mortgage-backed securities (agency and non-agency).

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

In general, fixed income ETPs carry risks similar to those of bonds, including interest rate risk (as interest rates rise, bond prices usually fall, and vice versa), issuer or counterparty default risk, issuer credit risk, inflation risk, and call risk. Unlike individual bonds, many fixed income ETPs do not have a maturity date, so holding a fixed income security until maturity to try to avoid losses associated with bond price volatility is not possible with these types of ETPs. Certain fixed income ETPs may invest in lower-quality debt securities, which involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

Lower yields - Treasury securities typically pay less interest than other securities in exchange for lower default or credit risk.

Interest rate risk - Treasuries are susceptible to fluctuations in interest rates, with the degree of volatility increasing with the amount of time until maturity. As rates rise, prices will typically decline.

Call risk - Some Treasury securities carry call provisions that allow the bonds to be retired prior to stated maturity. This typically occurs when rates fall.

Inflation risk - With relatively low yields, income produced by Treasuries may be lower than the rate of inflation. This does not apply to TIPS, which are inflation protected.

Credit or default risk - Investors need to be aware that all bonds have the risk of default. Investors should monitor current events, as well as the ratio of national debt to gross domestic product, Treasury yields, credit ratings, and the weaknesses of the dollar for signs that default risk may be rising.

S&P 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Indexes are unmanaged. It is not possible to invest directly in an index.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.