5 megatrends reshaping markets

The investing landscape is shifting in potentially profound ways.

- Global markets and economies have been undergoing several concurrent major shifts, or regime changes, in recent years.

- One of those shifts is in the fundamental drivers of corporate profits—which could have implications for potential investing returns.

- Other trends include a retreat from "peak globalization," the move to a more multipolar world order, and decarbonization.

- For investors, these trends could mean increased inflationary pressures, greater opportunities for diversification and active management, and more.

Have you gotten the sense, in recent years, that the tectonic plates of geopolitics and the global economy have been shifting under your very feet?

Major shakeups, or regime changes, like what we've been witnessing can be times when economic, political, or other dynamics shift so profoundly, that investors may have to toss out what they thought they knew about navigating the markets, and adapt their mindset and strategy to a suddenly changed terrain.

Fidelity's pros are focused not just on understanding these shifts as they happen, but on looking ahead to how the investing landscape might lie in 10 or 20 years—and what this means for successfully steering a portfolio.

Read on for 5 trends our pros have identified that are reshaping markets, and what investors can do to help set themselves up for success in this changing landscape.

This article was adapted from the Fidelity 2023 special report, A Strategic Allocator’s Guide to Productivity and Profits.

1. A new dynamic for corporate profits

The old regime:

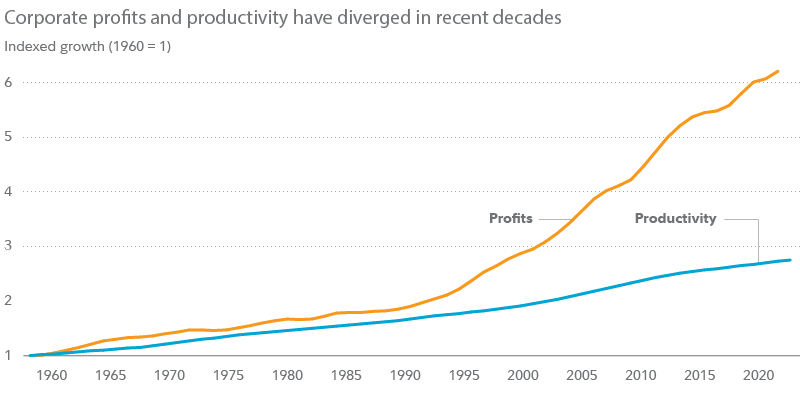

The past 2 decades have seen unprecedented levels of corporate profit growth, particularly compared with longer-term historical average relationships. Over the very long term, profit growth has been closely tied to gains in productivity, which is technically defined as the output per worker per hour worked. (Productivity can also be thought of as improvements due to technological innovations, like the advent of the internet, or due to having a better-trained, better-educated workforce.) But in recent decades, this relationship has taken a sharp divergence, with corporate profits surging as productivity gains lagged.

Past performance is no guarantee of future results. All data is inflation adjusted (real). Productivity is measured by GDP per hour. Profits are measured by national income and product accounts (NIPA) as compiled by the Bureau of Economic Analysis. Chart compiled using annual data. Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Haver Analytics, Fidelity Investments (Asset Allocation Research Team), as of 12/31/21.

What allowed profits to race so far ahead of productivity? Globalization provided companies access to cheaper foreign labor, which helped to hold down business costs. Rising industry concentration allowed firms to influence prices and wages, to the benefit of profit margins. And low interest rates (made possible by a prolonged period of low inflation) allowed many companies to issue debt and use the proceeds to buy back stock—reducing their outstanding share count and boosting earnings per share.

The new regime:

Ultimately, the divergence between productivity and profits over the past 2 decades may be unsustainable. The key drivers that supported this divergence—including globalization, industry concentration, and low interest rates—seem to be retreating or peaking. Going forward, productivity may once again become the fundamental, sustainable driver of corporate profitability.

Investment implications:

Corporate profits are the key long-term driver of stock market returns. So this potential recoupling of profits to productivity could have profound implications for investment returns in the coming decades. While productivity gains have been low in recent years compared with history—partly due to low levels of investments by companies and governments—there could be potential for positive surprises. Many of the other trends discussed below, such as deglobalization and technological innovation, could spur increased investment spending that leads to eventual productivity gains. Alongside these forces, a boost to future productivity may come from recent breakthroughs in artificial intelligence technologies, once their adoption becomes widespread.

2. A retreat from "peak globalization"

The old regime:

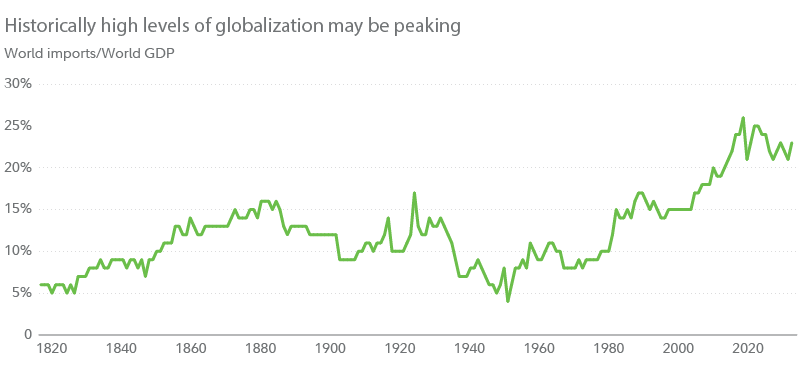

Globalization—the increasing interconnectedness and interdependence of the economies of individual nations—has been a powerful force in recent decades. Today, the overall level of global integration is high, as any shopper can tell by looking at where the goods they buy or the produce they eat has originated. But the world has perhaps already reached and passed the point of "peak globalization," and global integration may be unlikely to advance further from here.

The new regime:

Instead, the next phase for the global economy may be characterized by a retreat from globalization. COVID and the war in Ukraine have revealed the fragility of globe-spanning supply chains, in which shipping delays in one hemisphere can lead to bare store aisles in another.

Rapid deglobalization is not the most likely scenario. But there is already evidence that business and government priorities are shifting, to try to bring supply chains closer to home, or even back within national borders.

Chart compiled using annual data. Source: International Monetary Fund, World Bank, Fidelity Investments (Asset Allocation Research Team) as of 12/31/21.

Investment implications:

Globalization has helped to keep inflation low in recent decades, by letting companies produce goods in lower-cost regions and enhancing competition to allow cost savings for consumers. Reversing this trend could also increase inflationary pressures. It may take substantial investment to bring supply chains closer to home, which could lead to further increased costs for businesses. However, such investments could eventually help to spur stronger growth for some regions and countries, particularly among developed economies.

3. A new, less stable, balance of global power

The old regime:

The US exerted oversized influence on global relations and the global economy for nearly 3 decades, starting with the end of the Cold War around 1990. If not universally popular, the position of the US did create stability, as unipolar regimes tend to be more stable than regimes in which many nations compete for power.

The new regime:

Recent years have seen China's economic power and global aspirations rise, placing the world on a path toward a more multipolar dynamic. Historically, multipolar regimes have tended to be unstable backdrops, contributing to a less-balanced security equilibrium. These regimes do not always gravitate toward outright power wars, but the Russian invasion of Ukraine is a clear manifestation of the new multipolar era.

Going forward, one possibility is that evolving global dynamics will be defined by the division between countries seeking to defend the old, Western-led world order (such as the US and its closest allies), and countries that generally oppose Western democracy (such as China and Russia). A large third group of "nonaligned" nations, made up mostly of developing economies such as India, may deliberately attempt to steer clear of these divisions, and try to follow their own political and economic interests.

Source: Fidelity Investments (Asset Allocation Research Team), as of 12/31/22.

Investment implications:

Heightened geopolitical tensions tend to increase strategic competition for resources, which typically supports commodity prices and could further increase inflationary pressures. Along with deglobalization, this more fractured world order could lead to reduced correlations among investments around the globe. Heightened tensions could also lead to increased investments in strategically significant industries, such as defense and technology.

4. A long road toward decarbonization

The old regime:

For more than a century, fossil fuels have been the primary energy source fueling the global economy. This has helped to support a growing global population and improving global standards of living. It has also led to a significant increase in global carbon emissions, which scientists link to climate change.

The new regime:

Decarbonization has become a long-term priority around the globe that may impact economies and markets for decades to come. This encompasses efforts to improve energy efficiency, to generate more energy from clean sources, to remove or capture carbon from the atmosphere, and potentially to reach net-zero emission targets. But the decarbonization of the global economy may be an uneven transition, with shifting opportunities across industries, companies, regions, and nations.

Investment implications:

Perhaps surprisingly, commodity producers—particularly of fossil fuels—may benefit during the early phase of this transition. That's because underinvestment in traditional energy infrastructure in recent years, in addition to climate-related disruptions to agriculture, have already pushed commodity prices into higher and more volatile territory. However, traditional energy producers may suffer disadvantages over the long term, as renewable energy becomes more affordable.

Substantial investments may be needed over the coming decades in order to hit decarbonization targets. The energy, utility, and materials sectors will likely be at the heart of this transformation, with the technology and industrials sectors also impacted. But identifying specific winners and losers across industries, companies, and geographies may require strong active management and vigilance in understanding shifting conditions.

International Energy Agency estimates, excluding investments associated with fossil fuels, nuclear electricity, and carbon-capture technologies. Source: International Energy Agency, Fidelity Investments (Asset Allocation Research Team), as of 12/31/21.

Over the very long term, decarbonization efforts may represent a major technological transformation—akin to the invention of the steam engine or the information technology revolution—that can provide a boost for growth and profits. Historically, such transformations have entailed upfront costs for certain sectors, followed by economy-wide benefits that lowered costs across the board. And as the use of renewables becomes more widespread, electricity may become cheaper, benefiting company profits and consumers alike.

5. A changing landscape for portfolio management

The old regime:

Zoom out on the old regime, and the familiar investing landscape of recent decades comes into focus. Stock markets generally enjoyed high returns, thanks to profits that raced ahead of productivity. An era of low inflation permitted an era of low interest rates. And an increasingly interconnected global economy led to generally high correlations among investment types around the globe.

The new regime:

While the new investing terrain is still emerging, some key aspects of the lay of the land can already be identified. Inflation may be higher and more volatile, due to constraints on commodities, the retooling of global supply chains, and other forces. Higher interest rates are likely to go hand in hand with higher inflation. While returns potential may face some headwinds from low productivity gains of recent years, other long-term trends could create pockets of compelling opportunity. And lower correlations may lead to greater opportunities to diversify portfolios by geographic exposure.

Investment implications:

Encountering an unfamiliar landscape can be daunting, but it's no reason to abandon course. The complex dynamics of this new regime could show how the strengths of proactive security selection and portfolio diversification could help investors adapt to this shifting landscape in ways well suited to their needs.

To learn more about potential strategic opportunities in a dynamic and complex new regime, see our special report A Strategic Allocator’s Guide to Productivity and Profits

Next steps to consider

Asset Allocation Research Team (AART)

Access economic, fundamental, and quantitative analysis from our Asset Allocation Research Team.

Learn more

International Equity

Discover new ideas for your clients’ portfolios with our full range of international equity funds.

Learn more

Sustainable Investing Strategies

Help your clients align their portfolios with their investment and sustainability goals.

Learn more

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions pro vided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Investment decisions should be based on an individual's own goals, time horizon, and tolerance for risk.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market, or economic developments, all of which are magnified in emerging markets. These risks are particularly significant for investments that focus on a single country or region.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.