retirement

Fidelity 401(k) for Advisors

Help diversify your practice by adding workplace retirement plans to your book of business.

Explore opportunities in your current book of business

As an advisor, expanding your scope of expertise beyond personal wealth management allows you to showcase your value in new ways. Incorporating workplace retirement plans, such as 401(k)s, lets you deepen your book of business and strengthen your business model in three key ways.

Create a steady source of recurring income

Experience less impact from market fluctuations

Gain new referral sources and lasting client relationships

The market is primed and ready

Change is happening. Plan sponsors and their retirement plans are in flux, providing you with an excellent growth opportunity and an opening to start having important conversations with your current clients. If you’re not advising your current personal wealth clients on their workplace 401(k)s, another advisor probably is. This is your chance to get involved. And with Fidelity’s support, you don’t need to be a retirement expert.

Tips on kickstarting the conversation

Once you pinpoint current clients who might benefit from your advice on their workplace retirement plan, it’s time to connect and learn more about how they’re managing their plan today. Consider these three questions to kick-off the conversation:

Who is advising you on your workplace 401(k)?

Are you satisfied with that plan, that advisor, and the investment lineup?

How can I help?

Not a 401(k) expert? You don’t have to be.

Since 1977, advisors have looked to Fidelity for support managing retirement plans. In fact, 90% of our Defined Contribution (DC) business is sold through advisors, 34% of whom are wealth managers.²

Your browser doesn’t support video.

With Fidelity, you can expect industry-leading solutions,

platforms, and insights, among many other benefits:

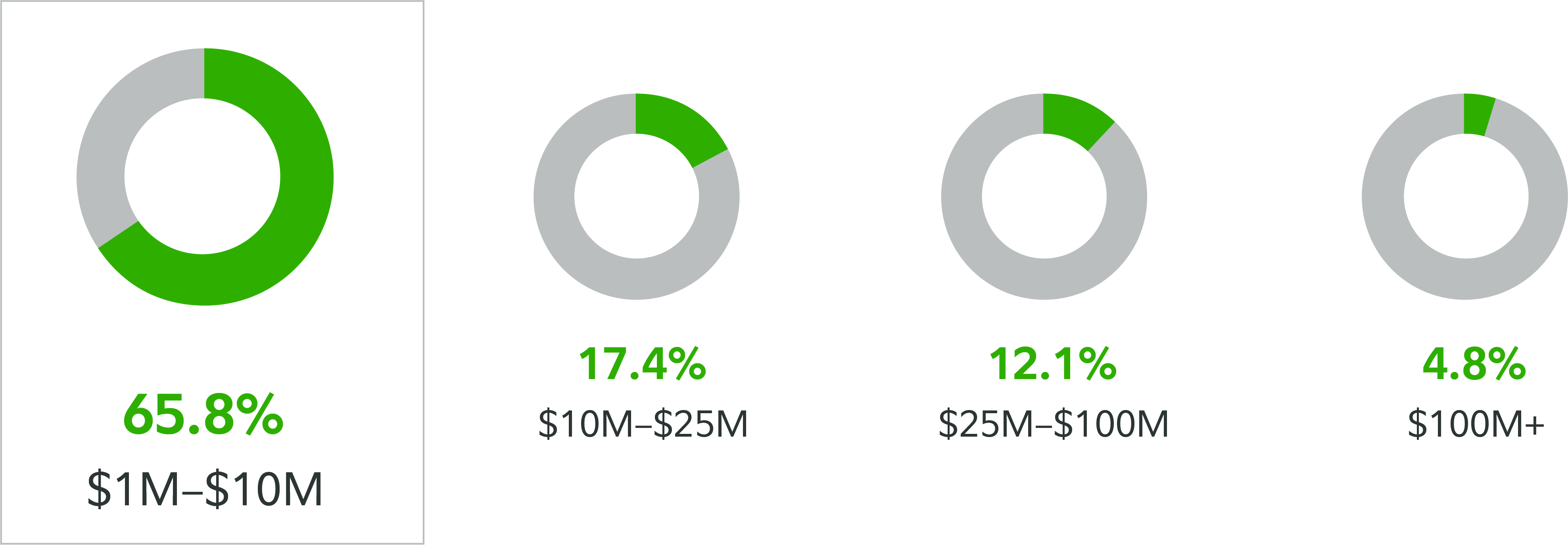

We’re well-versed in plans of all sizes—in fact, 65% of our plans have less than $10M in assets⁶

Discover how Fidelity supports advisors like you

Advisor Overview Brochure

See how we help advisors stay ahead and keep their edge to meet changing business needs.

Learn more

Fidelity University

This virtual learning hub for advisors helps them enhance and build their practices.

Learn more

TPA support

We help TPAs better understand the tools, resources, trainings, and best ways to support clients.

Learn more

Morningstar Fund Screener

This helps you build portfolios, as well as compare funds, other portfolios, and Fidelity Funds.

Learn more

Contact your Fidelity wholesaler today

Get in touch today for more information on how to get started.

1. Fidelity’s Plan Sponsor Attitudes Survey, 14th Edition, 2023 FMR LLC.

2. Represents the number of new Fidelity plans from 2019–2023, excluding tax-exempt plans, that have a recorded relationship with a wealth manager, based on internal Fidelity data.

3. Fidelity Workplace Investing DC Market Share, which includes all 401(k)-type assets in corporate and TEM plans, profit sharing and money purchase plans, Department of Labor, PLANSPONSOR.com, and marketing analytics estimates, as of December 31, 2022.

4. Fidelity Workplace Investing Operations Reporting, December 31, 2022.

5. Fidelity Corporate Finance, as of September 30, 2023.

6. Fidelity Workplace Investing data, which includes all 401(k) DC plans (excluding tax-exempt small market clients), as of May 31, 2023.