Key takeaways

- Short-term cash investments have grown in popularity since interest rates started rising last year.

- Those investments may become less attractive as rate increases slow and eventually stop.

- Bonds with longer maturities may offer higher returns and less reinvestment risk than short-term cash investments as rates stop rising.

Over the past 2 years, many investors have watched yields surge on low-risk CDs, short-term bonds, and money market mutual funds and they've found they could earn nearly 5% on their money without the ups and downs that come with investing in stocks.

Now, many of those CDs and other short-term vehicles that investors have put their cash into since interest rates began rising in May 2022 are maturing and owners face the question of what to do next.

Should they stay in cash or is it time to look at longer-term ways to help meet their investment needs with longer-maturity bonds?

What is reinvestment risk?

While cash is great for maintaining liquidity and flexibility and avoiding the risk of losing money in a market downturn, it is not risk-free. Having too much of it creates its own risks. Possibly the greatest of these risks is that a portfolio with too much cash won't earn enough over the long term to stay ahead of inflation and that it won't provide enough protection against inevitable downturns in stock markets.

Those risks may have seemed remote last year when you bought that 1-year CD and the economy was growing slowly but steadily. Now, though, according to Fidelity's Asset Allocation Research Team, the economy is still growing but a slowdown may be near. That slowdown could come in the form of a "soft landing" in which economic activity diminishes but growth remains positive, or it could look more like a historically typical recession. No one can say for certain, and that increasing uncertainty is something you should consider before you reinvest that money from your maturing short-term CD or bond.

If not cash, then what?

Historically, when the economy slows and eventually enters a recession, interest rates come down. That means that those attractive interest rates on money market funds will also come down. It also means when the short-term CDs and bonds owned mature, the investor may be unable to find new ones that pay as much as the old ones did.

Fortunately, there is an alternative to watching lower interest rates eventually reduce a portfolio's ability to generate the income an investor needs, and it does not involve investing in stocks. Longer-maturity investment-grade bonds issued by companies with high credit ratings and by governments have historically delivered higher returns than either cash or stocks when the economy is slowing and interest rates are no longer rising. By investing in bonds with maturities of between 3 and 10 years, or in a bond mutual fund or ETF, with durations typically found in the US Aggregate Bond Index, an investor may avoid the risks posed by holding too much cash, and may potentially continue to earn the level of return they seek from their portfolio.

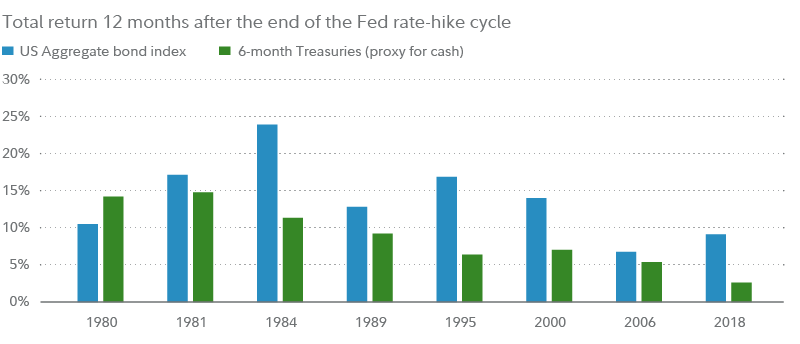

Past performance is no guarantee of future results.

Date ranges in the exhibit mark the end of previous rate-hike cycles. Six-month U.S. Treasuries used as a proxy for cash. Source: Bloomberg Finance L.P. and Fidelity Investments, as of 9/30/23.

What happens to bonds, cash, and interest rates in a slowdown?

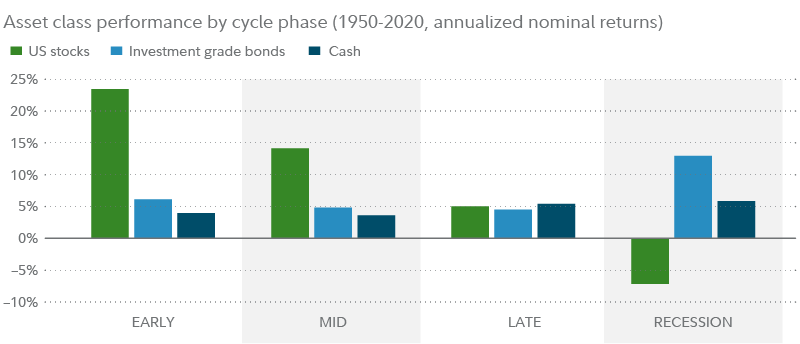

As the economy slows, central banks typically cut interest rates in hopes of stimulating an economic recovery and yields on money market funds and other short-term cash destinations come down. While yields on newly issued bonds will eventually also come down along with rates, the interest, or "coupon" that a bond pays remains unchanged until the bond matures or is redeemed by its issuer. That makes it possible for investors in longer-maturity bonds to enjoy today's relatively high yields well into the future, even after rates come down and short-maturity investment returns suffer. In fact, bonds are the only asset class since 1950 to produce double-digit gains during recessions, providing ballast against equity market declines.

Cycle phases determined by the Fidelity Asset Allocation Research team. For illustrative purposes only. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. It is not possible to invest directly in an index. All indexes are unmanaged. Domestic Equity—Dow Jones U.S. Total Stock Market Index; Foreign Equity—MSCI ACWI ex USA Index; Investment-Grade (IG) Bonds—Bloomberg U.S. Aggregate Bond Index. Source: Fidelity Investments, Morningstar, Bloomberg Finance L.P., as of 12/31/20.

Bond yields follow interest rates and they also move in the opposite direction of bond prices. That means when rates and yields come down as they are likely to as the economy slows, bond prices are likely to rise. Because the total return that a bond delivers to its holder is a combination of the coupon yield and the bond's price, the combination of potential rising prices in the future and relatively high yields in today's market could deliver returns that are significantly greater than those available on short-term cash investments.

Keeping your balance

Another potential risk that comes from not reinvesting your maturing cash into longer-term bonds stems from the fact that cash has historically not provided as much protection as bonds from the declines in stock prices that often take place during economic slowdowns. In recessions, it is not unusual for stocks to decline by double-digit amounts. But when stocks have historically sunk, bond prices have often risen by double-digit amounts. While cash did not lose value like stocks during those periods, it also did not gain in value like bonds, which means that the overall value of an investor's portfolio was more likely to be pulled down by sagging stocks if they had too much cash and not enough bonds.

Time to move?

To be sure, cash still looks attractive right now. According to Fidelity's Asset Allocation Research Team, the US economy remains in the "late" phase of the economic cycle, in which stock, bond, and cash returns historically have been very close to each other. So far in 2023, bond prices have also been held back by tighter monetary policy. That may make it seem like the time for longer-term bonds has not yet arrived, but financial markets are constantly in motion and they don't tell investors what they may do next. That makes it nearly impossible to pick the perfect moment to reinvest your cash into bonds, so investors who stay in cash now may risk missing their opportunity.

Finding the right mix of cash and investments

Professional investment management services generally do not allocate large amounts of money to cash. Instead, they stay invested and follow an investing plan to help reduce the risks posed by staying too long in cash. A well-managed portfolio looks at the investor' timeline, goals, and feelings about risk to create a mix of investments that's right for them.