SPOTLIGHT

Help clients maximize their Social Security benefits

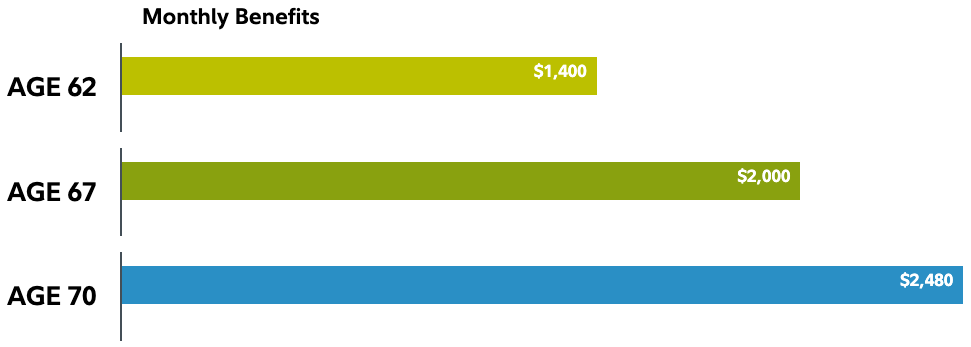

When claiming Social Security benefits, it's important for retirees to understand their options to maximize their benefit.

Waiting to collect Social Security benefits until age 70 can add up to an extra $1,080 per month.

The hypothetical example assumes that the person is not working in retirement. Sample benefit amounts are not exact due to rounding. They do not reflect annual cost-of-living adjustments or taxes. Had taxes been taken into account, the amounts would be lower. Benefit at full retirement (age 67) is assumed to be $2,000 per month.

Health status

Longevity

Retirement lifestyle

There may be opportunities for clients to boost their Social Security benefits1

Strategies for couples

Spouses should evaluate options to determine when to file for benefits

Survivor benefits

Typically works best if one spouse is expected to outlive another

Former spousal benefits

Ex-spouses may be eligible for a portion of benefits

Start a conversation with your clients

Understanding Social Security Flyer

Strategies to help you maximize your benefits.

Download the flyer

Social Security Presentation

Options to help you maximize your benefits.

Download the presentation

Social Security Seminar Invitation Flyer

Helping You Maximize Social Security Benefits for Your Retirement Income Plan.

Download the flyer

Want to know more?

Let's talk about retirement solutions for your clients.

Explore our latest research & insights